One out of three people in Nova Scotia live with at least one disability, such as chronic pain. However, 62.2% are working or looking for work, which means they’ll be able to work despite their injuries.

Some people, however, may develop medical conditions that prevent them from returning to work. It may be because of a disease or injury that results in long-term disability. When medical evidence supports it, they may be eligible for long-term disability payments.

Long-term disability benefits in Canada, including Ontario and New Brunswick, generally cover between 60 and 70 percent of a person’s wages. For example, you were injured in a car accident in Halifax that prevented you from earning your annual wages of $100,000. Disability insurance may provide you with a monthly payment of $6,000.

Long-term disability (LTD) benefits are typically available after you have exhausted all other benefits, including sick leave and short-term disability. Once it kicks in, it’s a good safety net during a challenging time.

However, are LTD payments taxable in Nova Scotia? As with most legal matters, the answer is that it depends. The general rule is that LTD payments are taxable, but whether your LTD payments will be taxed depends on several factors.

Factors Determining LTD Tax Consequences

People living in Nova Scotia have access to various LTD benefit programs. The ones that apply to you will determine whether you need to report the income on your tax returns.

Long-term disability insurance

Many employers in Nova Scotia offer long-term disability coverage under a group insurance policy as an employee benefit. If you qualify for LTD benefits under group insurance and the employer pays the insurance premiums, you’ll need to pay taxes on your LTD payments. You’ll still need to report LTD payments as income if you paid the premiums as pre-tax salary deductions.

However, if you paid the premiums with post-tax dollars, you don’t have to report LTD payments on your tax returns.

Sometimes, the employer-employee arrangement is a bit more complex, whereby the employer pays a portion of the premiums. In that case, you’ll need to report the part of the payment made by the employer.

For example, let’s assume that your employer has paid 40 percent of the premiums, and you paid the remaining 60 percent with post-tax dollars. If you received $60,000 that year from your LTD insurance claim, you’ll need to report 40 percent ($24,000) as income.

What if you paid for your portion of the premium with pre-tax dollars? In that case, you’ll need to report all the LTD payments from the insurance company as income.

If you have private insurance with LTD coverage and paid the premiums with post-tax dollars, the Canada Revenue Agency (CRA) won’t require you to pay taxes on LTD claim payments.

When you get retroactive disability benefits as a lump sum payment, the insurance company and employer will file a T1198 with the CRA. This will allow you to qualify for a special tax calculation to reduce the tax burden on your LTD payments.

Canada Pension Plan Disability

Another source of financial assistance for LTD is the Canada Pension Plan Disability (CPPD) benefits. To qualify, you’ll need to meet the following requirements:

- You must be under 65

- You must have contributed to the program in four of the previous six years (three years if a contributor for 25 years or more)

- You must demonstrate that you have a long-term physical or mental disability preventing you from substantially gainful employment

If you qualify, you’ll receive a maximum of $1,538.67 per month in 2023, which will increase every month to a maximum of $1,546.05 in December 2023 until you reach 65.

You can apply for CPPD even if you have LTD coverage under your insurance policy. However, the insurer will offset any benefits you receive from CPPD against the LTD payment you should get from them.

It might be better not to apply for CPPD benefits if you paid for LTD insurance with post-tax dollars. This is because CPPD benefits are taxable, and the government will often deduct the tax from the monthly payments. You’ll probably end up with more money by sticking with your LTD insurance payments rather than combining it with CPPD benefits.

However, you might pay less taxes for CPPD benefits if it’s your only source of income. Your personal tax and any disability credit you qualify for can significantly reduce your tax burden. The nuances of these tax issues can be confusing, so you should consult LTD lawyers from Diamond & Diamond in Nova Scotia for legal advice.

Nova Scotia disability support program (DSP)

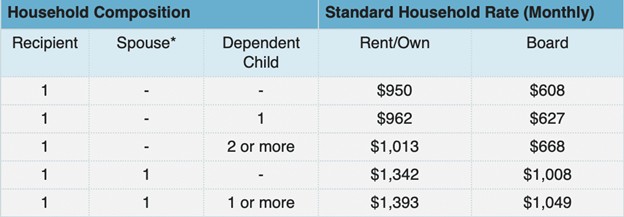

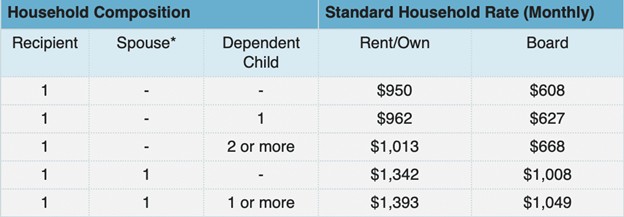

If you don’t have insurance and don’t qualify for CPPD, you can apply for the Disability Support Program (DSP), which supports Nova Scotians, including children, with intellectual, mental, or physical disabilities. You may qualify for monthly funding at a Standard Household Rate to cover the cost of shelter and other essentials.

If you’re married, have two dependent children, and you own a home, you’ll receive $1,393 per month. If you’re single, have no children, and live in a shelter, you’ll receive $608 per month.

As with most disability payments, DSP benefits are taxable. However, like CPPD benefits, tax credits may cover your tax obligations if DSP is your only source of income.

Workers’ Compensation Board (WCB) of Nova Scotia

Companies in specific industries with three or more workers in Nova Scotia must register with the Workers’ Compensation Board (WCB). According to the Workers’ Compensation Act, workers’ compensation insurance covers work-related injuries, serious or permanent impairment, or death.

If you sustained injuries while at work or developed an illness related to your job, you may qualify for WCB benefits. These include two types of LTD benefits: Permanent Impairment Benefit (PIB) and Extended Earnings Replacement Benefit (EERB).

PIB pays disability claims benefits based on a permanent medical impairment assessment to get a permanent impairment (PI) rate. PIB is calculated as (PI x 30%) x (85% x net average weekly earnings).

If the injured worker’s lost wages are over PIB, the worker qualifies for EERB. However, the WCB caps the maximum assessable earnings workers can receive annually in WCB benefits.

Generally, the CRA doesn’t impose taxes on WCB benefits. However, the employee must report the amount in the T5007 slip they receive from the WCB as income on their returns. While it’s not taxable, they need the information to claim the deduction.

Personal injury settlements

Personal injury settlements sometimes include lost income due to serious injury, preventing accident victims from returning to work. Technically, this should be taxable as income. However, section 81 of the Income Tax Act (Subdivision G) says that settlements from personal injury awards are exempt from income or capital gains tax. The CRA also exempts general damages, such as pain and suffering, from taxes.

Did you know?

Victims or their loved ones receiving compensation for injuries or death resulting from criminal acts don’t have to report it as income.

Consult a Lawyer About Taxation of LTD Benefits in Nova Scotia

Generally, LTD benefits in Nova Scotia are taxable unless they’re personal injury awards. However, tax law, like personal injury law, is subject to interpretation. It’s best to know if you need to report LTD benefits as income to avoid legal problems.

Take the guesswork out of your LTD benefits by consulting Diamond & Diamond Lawyers Nova Scotia before you make an LTD claim. The law firm has a team of experienced personal injury lawyers who can explain your LTD tax obligations and your rights to you based on the circumstances of your case. A lawyer can also help you with the claims process to maximize your chances of success.

Book a free consultation for legal services today!

Long-term disability benefits can help you manage a challenging situation, but there are tax implications. Diamond & Diamond Lawyers Nova Scotia can help you make the best choices.

FAQS on Long-Term Disability Lawyers in Nova Scotia

What is an elimination period?

How long do long-term disability benefits last?

It depends. If you’re receiving benefits from your insurance company, the policy will provide conditions for continued coverage. If you get CPPD, payments continue until you turn 65. In either case, you must meet the policy or program’s definition of disability to continue receiving benefits.

How do I qualify for long-term disability in Nova Scotia?

Any medical condition that prevents you from engaging in gainful employment qualifies as a long-term disability. However, most disability insurance policies require you to have had gainful employment at the onset of the debilitating injury or illness.

It also requires that your condition prevents you from performing the same job for two years, known as “own occupation.” After two years, the definition of disability changes to any job. If you’re totally disabled, the insurer may continue to pay.

Buying, Selling or Re-financing? Contact Our Team Today

Chat Now

1-888-INFO-

1-888-INFO-